Our way of working

We aim for a responsible culture and ethically sound ways of working. As an earnings-related pension insurer, we collect pension provision funding from public sector employers and employees. This is why our operations highlight responsibility for the transparency and justified use of funds.

Keva’s Board of Directors adopted Keva’s Code of Conduct in August 2022. Our employees as well as members of Keva’s Council and the Board of Directors undertake to comply with the Code.

Our Conduct of Conduct defines where we want to exceed the level set by legislation.

- Keva’s mission is to ensure pension cover.

- Keva’s operations are guided by legislation.

- Keva secures pension benefits and a stable contribution level.

- Keva’s operations are guided by customer needs.

- Think before you click. Information security and data protection are at the heart of Keva’s operations.

- Prevent conflicts of interest, corruption and bribery.

- Wellbeing of employees is number one.

- Your work is genuinely responsible.

- Be active, open and transparent in your communication.

- Act correctly. Keva strives to ensure an ethical corporate culture in which Keva employees act correctly and in accordance with the shared values.

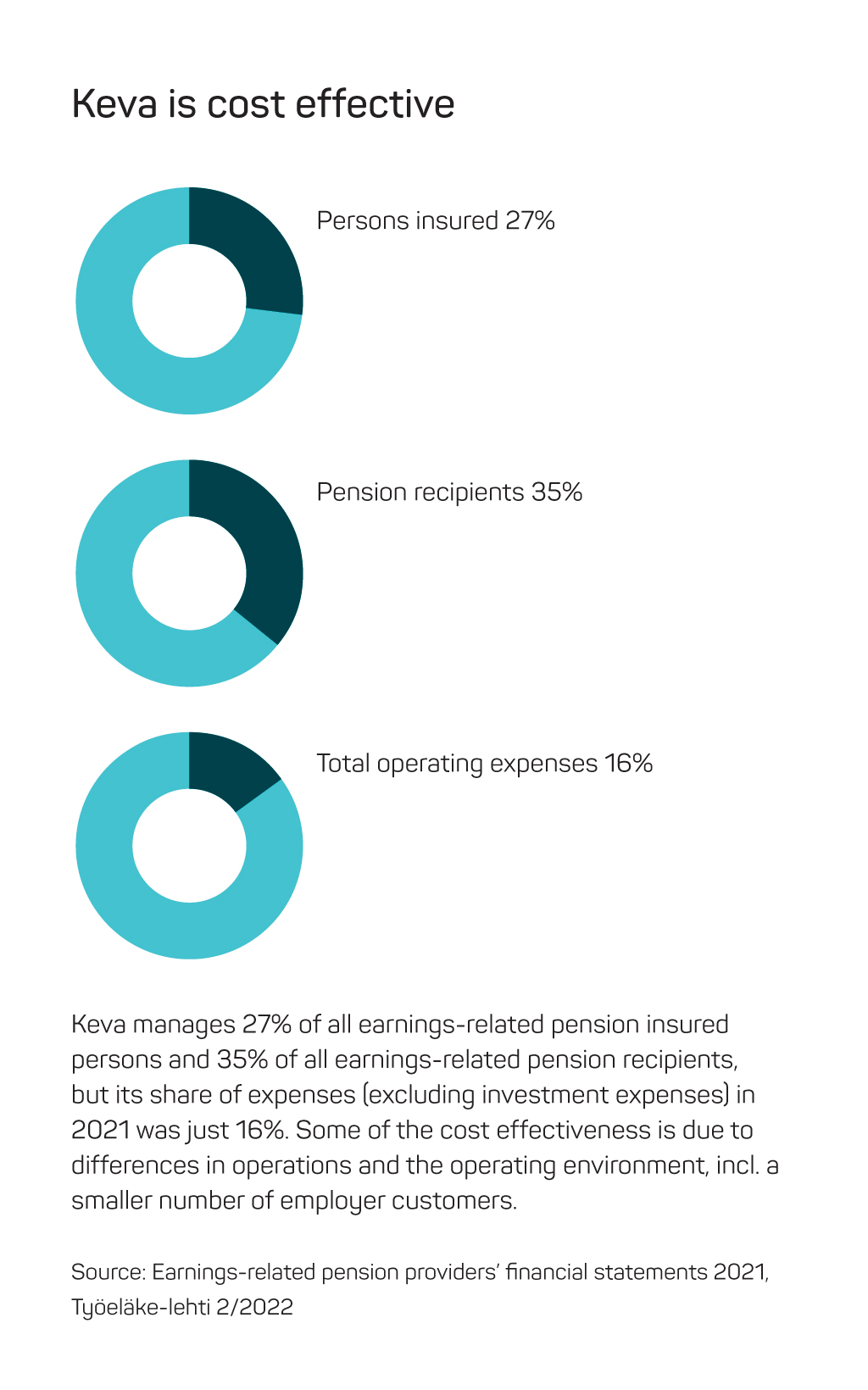

Aiming for cost efficiency

We are responsible for implementing and funding local government pensions together with the municipalities and joint municipal authorities. Besides this, we also administer State and Evangelical Lutheran Church pensions and the pensions of Social Insurance Institution of Finland salaried employees. In May 2020, the Finnish Parliament passed an act under which also implementation of Bank of Finland employees’ pensions was transferred to Keva.

Our cost efficiency cannot be directly compared with the efficiency of private sector earnings-related pension companies. We come out well in comparisons of total business costs (excluding investment costs) in the financial statements with the number of insured.

Keva’s business costs are lower because our customers are defined by law. Unlike private sector TyEL pension insurance companies, we have no costs from marketing or distribution channels for canvassing new customers or insurance transfers. Our customers are on average larger than those of TyEL companies and pension insurance is more cost efficient in terms of personnel numbers in large organisations.

Guidelines prevent abuses

We invest pension liability fund assets securely and profitably. In addition, we ensure compliance with legislation governing the operation of the securities market. Besides legislation and regulatory provisions prohibiting the abuse of insider information, we comply with Keva’s Insider Guidelines.

Keva’s Board of Directors adopted the guidelines governing related party transactions and conflicts of interest situations in 2015.

Political influencing

On 9 September 2021, Keva’s Council elected the Board of Directors for the term of office 2021–2023. In the election process, particular attention was drawn to the fulfilment of competence requirements under the Act on Keva.

Responsible procurements

We strive to reduce the use of energy and materials as well as harmful environmental impacts during the entire lifecycle of products, services and buildings.

Keva’s units make purchases independently and are responsible for their purchases and their responsibility. Where necessary, our Legal Affairs unit assists in legal issues related to the competitive tendering for products and services.

In 2022, Keva recruited a procurement specialist who started work in January 2023.

We use Hansel, a central purchasing body for central and local governments in Finland, in purchases and Hansel takes into account the responsibility aspects.

Risk management and contingency planning

We want to safeguard the rights of the ensured and pension recipients in all situations. This is why we work on risk management aimed at developing operations and processes as well as at supporting the achievement of Keva’s goals.

An independent risk management function oversees and supports the implementation and maintenance of Keva’s risk management principles and process.

Keva has a Compliance officer and from 1 May 2022 also an Investment compliance officer. The Compliance officer reports to the Administrative Director, the CEO, the Risk Management Committee and to the Board of Directors. The Investment compliance officer reports to the Administrative Director, the CEO the risk management team, the Audit and Risk Management Committee and the Board of Directors.

Aiming to continue services

We are making contingency plans at both the Keva level and in different functions. Planning primarily aims to ensure pensions payment and our other key services also in the event of any disruptions and emergency conditions.

You can read about risk management and contingency planning in our Annual report 2022 (pdf).

We ensure privacy and data security

We ensure data confidentiality, integrity and availability. We ensure privacy and strengthen the awareness and competence relating to the data security of all Keva employees.

These key data security policies are part of Keva’s Code on Conduct.

Lawful basis for the processing of personal data

We process personal data that must be stored for a very long time or in perpetuity. Seeing or using the data must be justified for work purposes. Browsing or using personal data leaves a log record and if necessary we can establish on this basis who has processed the data.

Employee customers also have a right to request information about who has seen their data.

Inspection of Personal Data (pdf)

Strong identification and signing based on banking codes are used in online services, like the MyPension service, for employee customers.

Log data under control

All our information systems have been classified to implement the EU’s General Data Protection Regulation (GDPR). The information systems have designated owners who are responsible for the processing of data contained in the system. This is how we ensure that the systems also produce adequate log data from the privacy aspect.

Read more about the processing of personal data: Data protection

Users have strong identification

Keva employees can connect to Keva’s intranet, information systems and files by using so-called identified devices. If a Keva employee wishes to use devices other than Keva’s, special identification, authentication, is required.

Strong identification ensures that outsiders are unable to access Keva’s emails or O365 services.

During 2022, there were 16 data protection triggers and 17 data protection incidents.

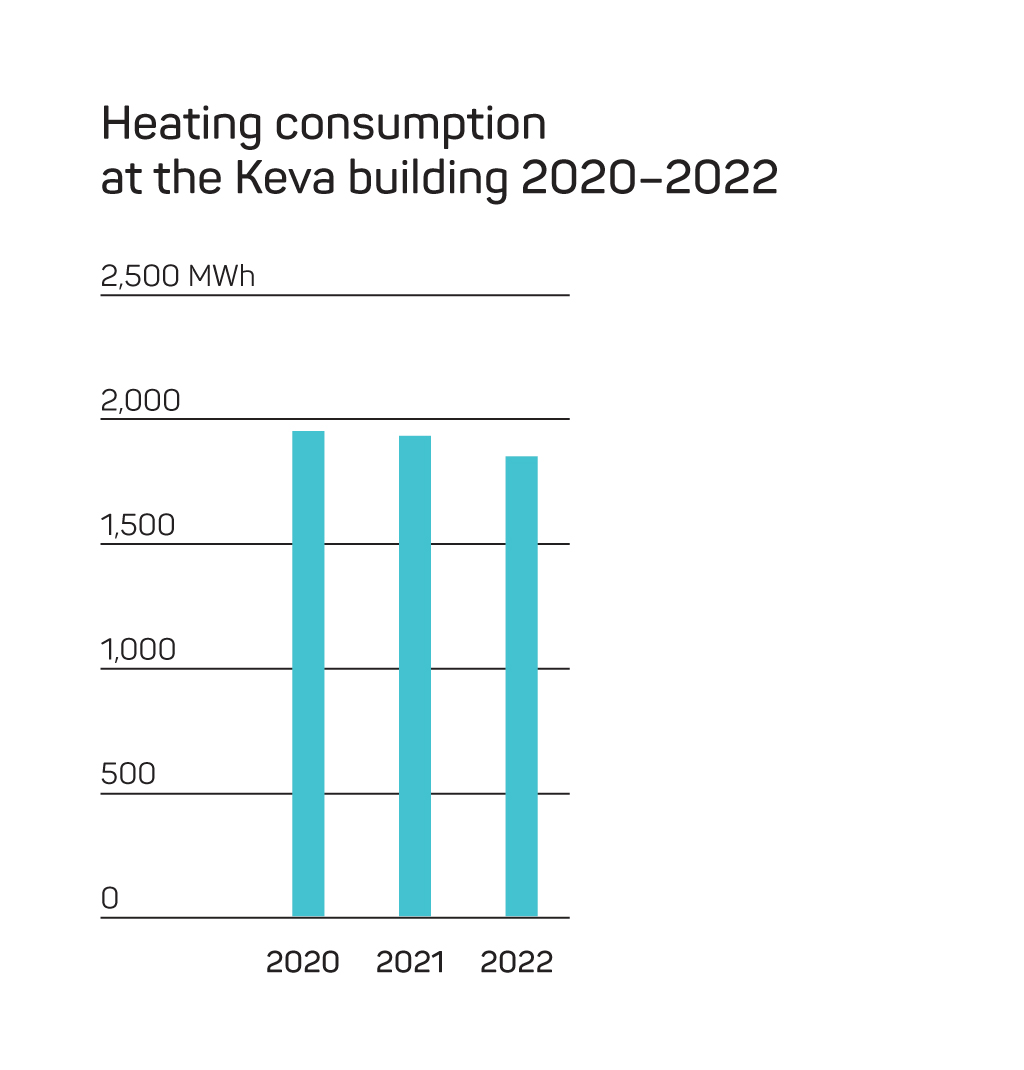

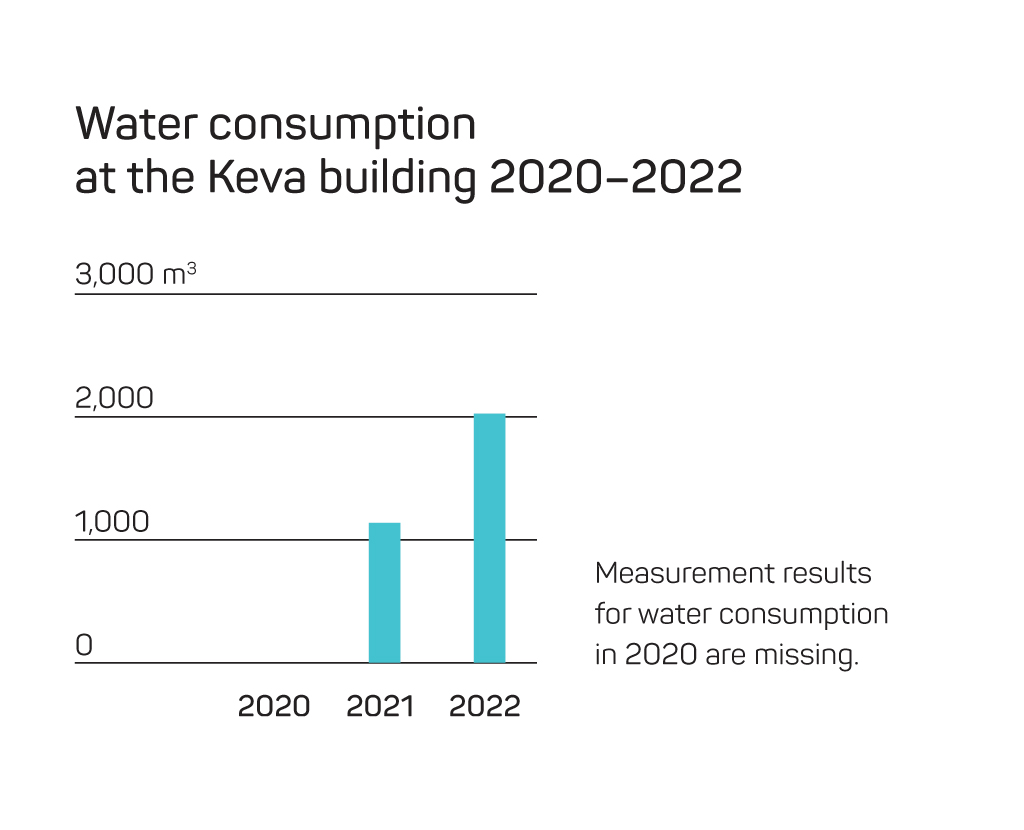

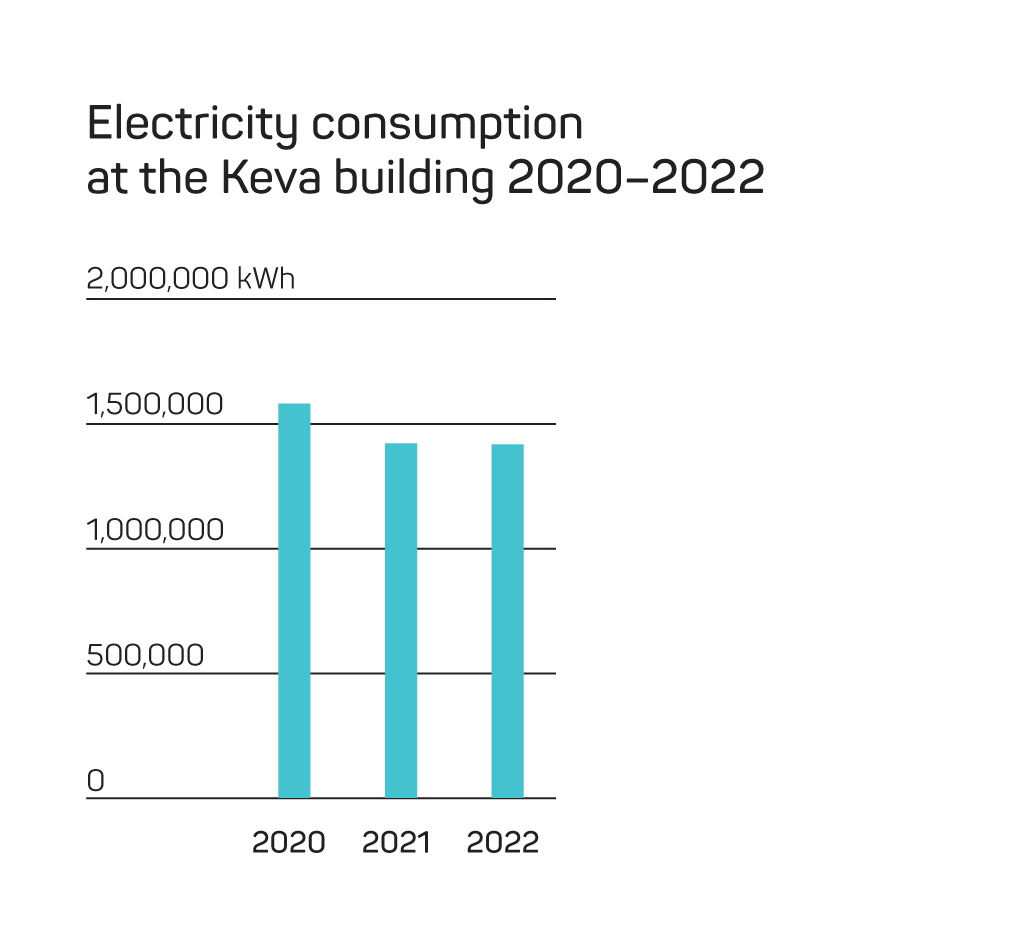

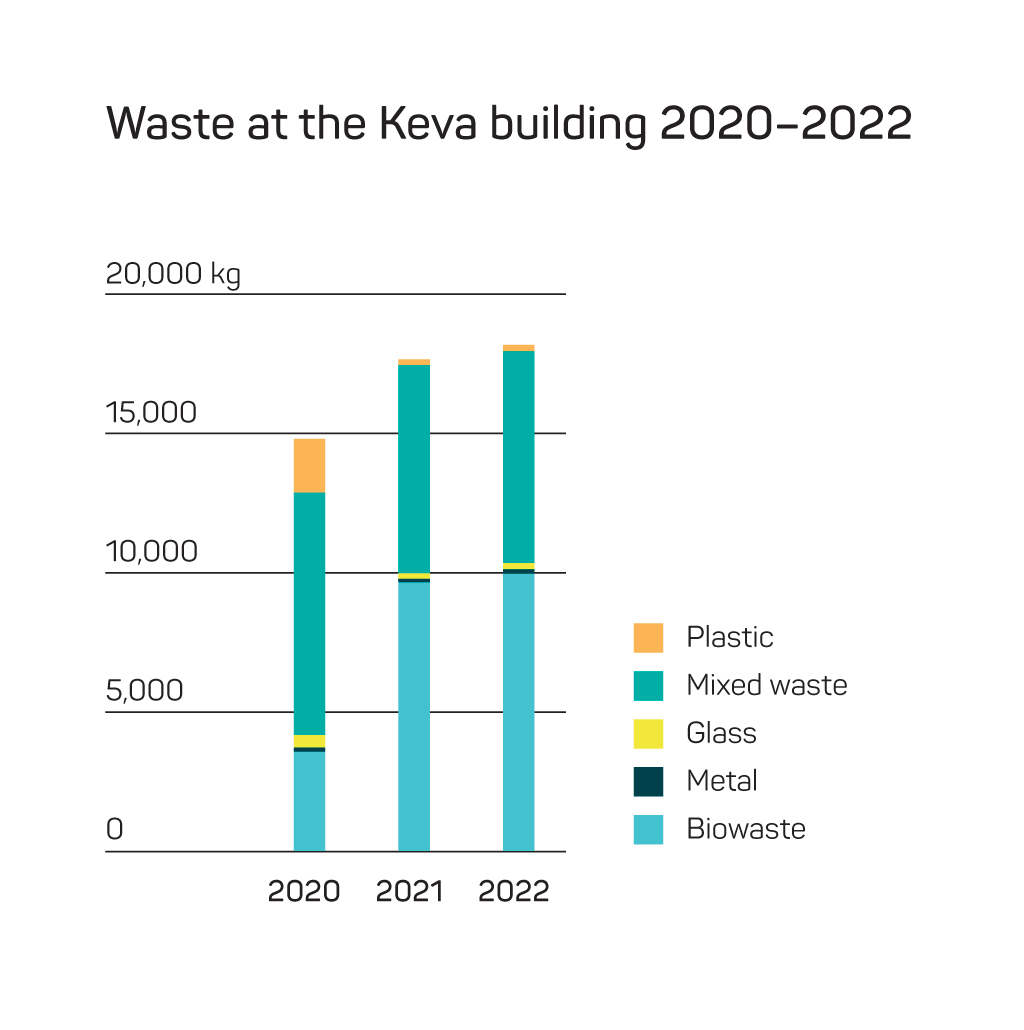

Environmental aspects of the Keva building

The environmental impacts of Keva’s own operations are very low. They are measured at the Keva building at Unioninkatu 43, Helsinki.

Keva switched over to hybrid working on 15 March 2022 and the occupation rate of the building rose sharply compared to the years of corona virus. Apart from the summer holiday season, an average of 130-140 persons worked in the Keva building compared to just a few dozen during the pandemic.

The solar power plant installed on the roof of the Keva building in October 2021 generated 40,361 kWh of electricity during 2022. This was 3% of the electricity used by Keva

Green Office is everyday eco-deeds

The WWF audited and renewed the Green Office logo and certificate at the Keva building on 3 December 2020.

Green Office has promoted internal discussion and encouraged everyday eco-deeds. For many Keva employees, impacting on the work environment is a concrete approach and way to promote responsibility in the workplace.

Stakeholders and dialogue

We aim to ensure that the image Keva employees and key external stakeholders have of Keva is based on correct, adequate and up-to-date information.

Our reputation is based on, for example, the services our customers receive and customer experiences, management, employee satisfaction and dialogue engaged in with stakeholders.

We strive to ensure that key stakeholders understand Keva’s relevance and role in society, our operations and goals. At the same time, we ensure that we have the right, adequate and up-to-date information about Keva’s operating environment.

Dialogue about the sustainability of the earnings-related pension system

Keva’s top management meets media representatives as well as, for example, labour market organisations, pensioner organisations and other actors in the pension sector. Dialogue takes place among other things about the sustainability of the funding of the Finnish pension system.

We are also in regular contact with local government actors, particularly the Association of Finnish Municipalities, Municipal Finance (MuniFin), the Municipal Guarantee Board and Local Government and County Employers KT.

We work with i.a. Finnish Pension Alliance Tela, the Finnish Centre for Pensions and other actors in the earnings-related pension sector.

More than the Act on the Openness of Government Activities requires

We are part of public administration and comply with the Act on the Openness of Government Activities and principle. Under this Act, documents are public unless they have specifically been ordered to be kept secret. The secrecy obligation may apply to, for example, the wealth or state of health of a private person or information relating to the security of organisations.

By law, we keep a record of matters arising. The transparency of our procurement process is indicated by the fact that we justify and make information available about the price and quality comparisons we use in comparing tenders to all tenderers.

Openly and expertly

We tell more about Keva’s operations and our own expertise than required under the Act on the Openness of Government Activities. We take a positive approach to people needing information and actively communicate.

We publish the minutes of Council and Board meetings online. Interested parties also receive public appendices to the minutes or abbreviations of the appendices to be kept secret within the limits of secrecy provisions. The drafts, internal preparatory materials and documents generated in our work are not public, but by law we can, at our own discretion, publish also internal documents.

We use as clear language as possible. We write the reasons for the decisions issued to employer and employee customers in standard language with sufficient accuracy and do not hide messages behind phrases.

Keva’s key stakeholders include

- Employee and employer customers

- Political decision-makers and public officials preparing decisions

- Labour market organisations at the trade union and central organisation level, wage earner networks

- Pensioner organisations

- Local government actors: municipalities, counties, hospital districts

- The Association of Finnish Municipalities, Local Government and County Employers KT, Municipal Finance (MuniFin), the Municipal Guarantee Board and the State Treasury

- Other actors in the earnings-related pension sector such as the Finnish Centre for Pensions, the Finnish Pension Alliance Tela, Arek, earnings-related pension companies and the Finnish Pension Funds (ESY)

- Finnish media, also foreign mass media as a target group for investment operations

- Working life development and research institutes

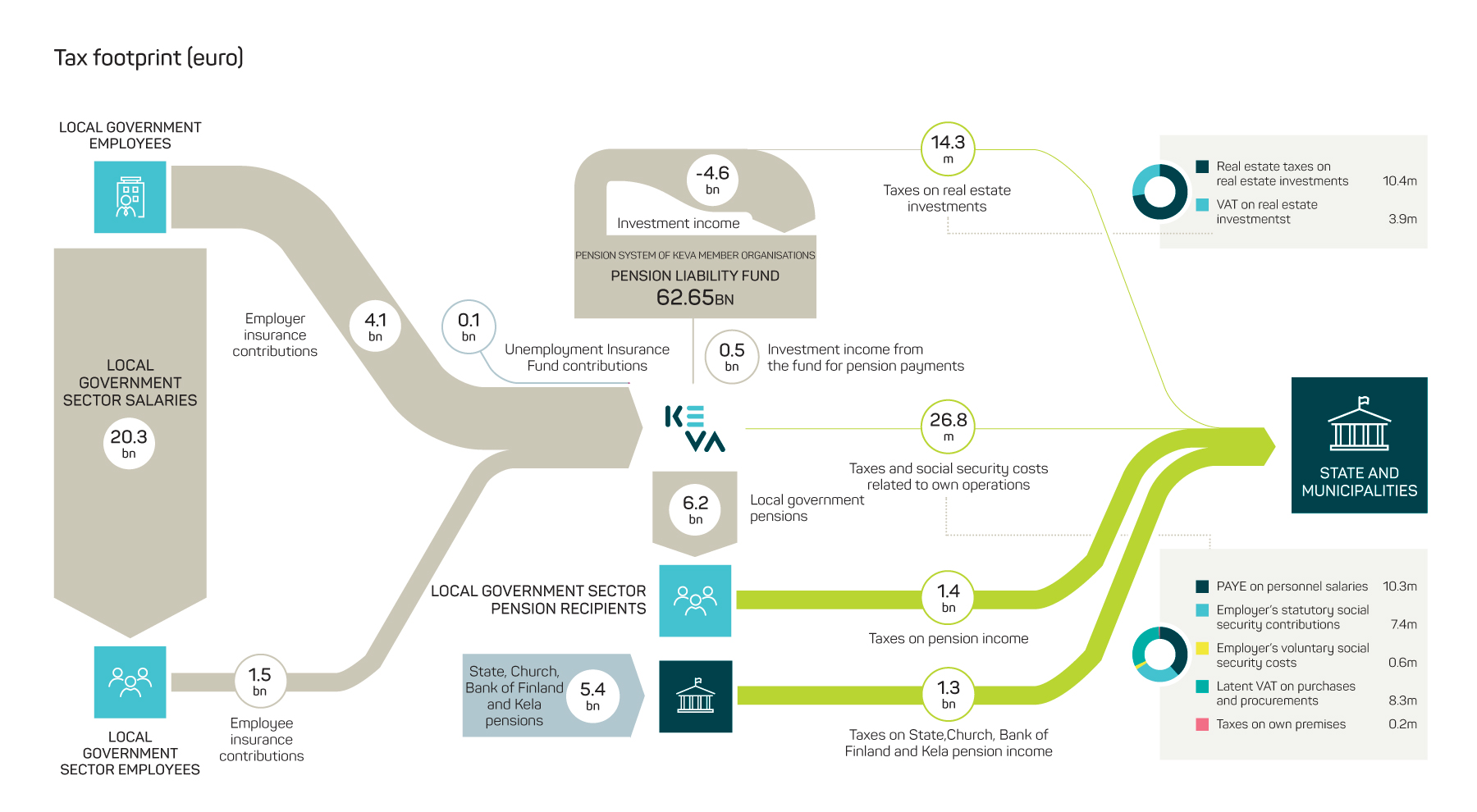

Tax footprint

Our tax footprint in Finland is made up of withholding tax on pensions paid as well as taxes and social security costs relating to our own operations. In addition, we pay taxes on real estate investments.

In 2022, we paid EUR 11.5 billion in pensions and rehabilitation support, of which EUR 2.7 billion was withheld. Taxes and social security costs for Keva’s own operations totalled around EUR 41 million (2021: EUR 39 million).

Taxes on investment income in accordance with laws and agreements

Earnings-related pensions are financed by pension contributions and investment income, and investment operations are intended to secure the long-term funding of pensions. Under legislation, earnings-related pension funds must be invested securely and profitably. Keva and other earnings-related pension insurers pay no taxes to Finland on their investment income. If taxes on investment income were taxed to the home country already at the funding stage, the deficit would have to be filled by e.g. increasing pension contributions.

We invest so that the security and income perspective are implemented at the same time. This is why we diversify investments globally among different investees. Some 88% of our investment assets are diversified outside Finland’s borders.

We plan foreign investments in accordance with international law as rationally as possible; we don’t pay taxes unnecessarily, twice or excessively on investments outside Finland. We ensure that tax on investments is in accordance with international tax laws and international tax agreements between Finland and source countries.

Image from the report: Tax footprint (jpeg)