Pension funding is based on pension contributions and investment income

The pensions payable in 2016 will be funded in their entirety from pension contributions collected from employers and employees. This situation is about to change in the coming years as pension expenditure will outstrip pension contributions. At this point, the fund will be also drawn upon to finance pension expenditure. The precise year when this occurs will depend on several factors including payroll development and the level of the pension contribution.

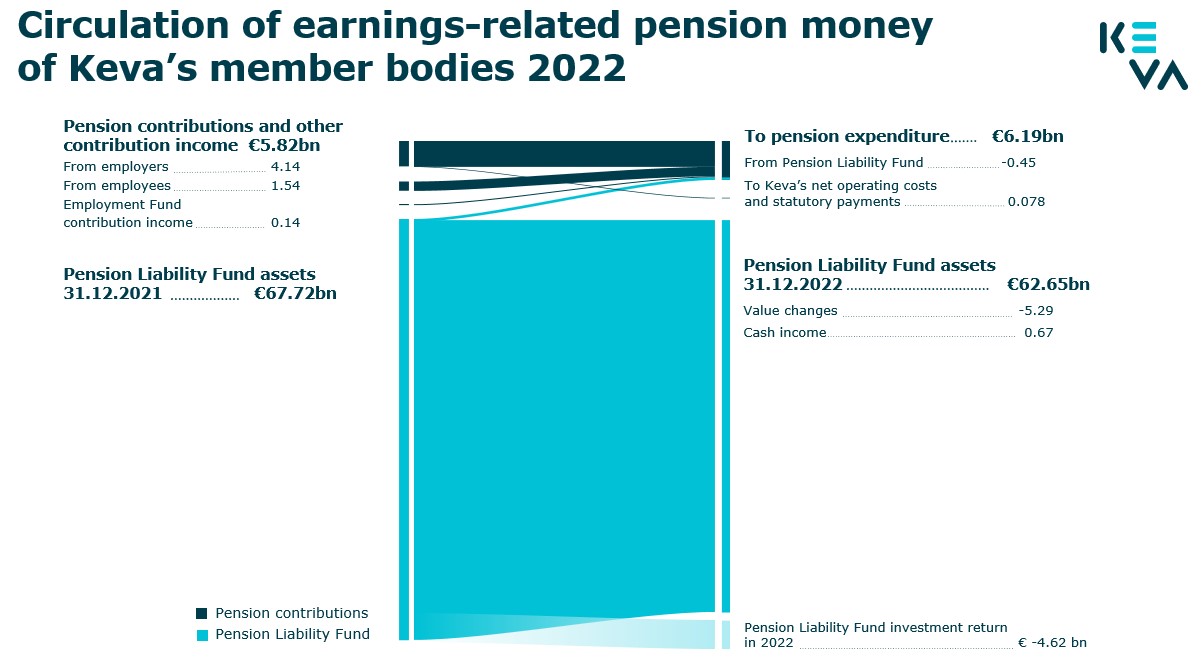

According to funding calculations, the fund’s assets and income will be drawn on annually in an amount equal to ca. €1.3 billion in today’s money, i.e. roughly €13 billion over ten years. Pension expenditure financing from the fund will accelerate in the 2030s when the fund is projected to account for over one quarter of total pension expenditure. Safeguarding the pension system and its liquidity requires investment operations to prepare not only for fluctuations in the investment markets but also for the materialisation of risks pertaining to e.g. the funding base.

The level of the pension contribution is determined on the basis of the obligations of the defined benefit pension system and it endures over generations. The pension system’s assets and foreseeable contribution income must be in balance with foreseeable pension expenditure. The pension contribution is kept stable by drawing on the fund to a higher degree in order to finance peak pension expenditure.

The local government pension system has a greater need for contributions than the earnings-related pension system in the private sector. The underlying reasons include the sector’s higher than earnings-related pensions accruing prior to 1995, the predominance of women in the local government workforce, their older age breakdown and longer life expectancy. Payroll development in the local government sector is moreover presumed to be lower than in the private sector owing to public sector restructuring in particular.

Pension contributions are currently collected on the basis of both payroll and pension expenditure. All employees contribute a share of their salary as specified in the private sector contribution rates. Employers make a payroll-based contribution on the basis of the wages and salaries paid by them as well as a separate early retirement pension expenditure-based contribution on the basis of wages and salaries, early retirement pension expenditure or a combination of the two. Employers also pay a separate pension expenditure-based contribution on the basis of pension expenditure arising from pensions in payment that have accrued prior to 2005.

The components of the pension contribution are determined to correspond to the level of the earnings-related pension contribution in the private sector. Any contribution in excess of the level of earnings-related pension is collected on the basis of pension expenditure.