Pension application and foreign countries

If you have worked abroad, you can apply for any pension accruing for this work.

If you have earned a pension in Finland but are now resident abroad, you will receive your Finnish pension regardless of where you live.

You can report information on work done abroad in advance even if you are not yet applying for a pension.

If you have already retired, see the instructions on the payment of pension abroad website

How to apply for a foreign pension when you live in Finland

If you have worked abroad, use the instructions below to apply for any pension accruing on this work.

If you have worked in an EU or EEA member state or in a country with which Finland has a social security agreement

If you have worked in an EU or EEA member state or in a country with which Finland has a social security agreement, you should apply for your foreign pension through your own pension provider in Finland. So if you are a Keva customer, you should send your application to Keva.

Pensions are paid from one country to another.

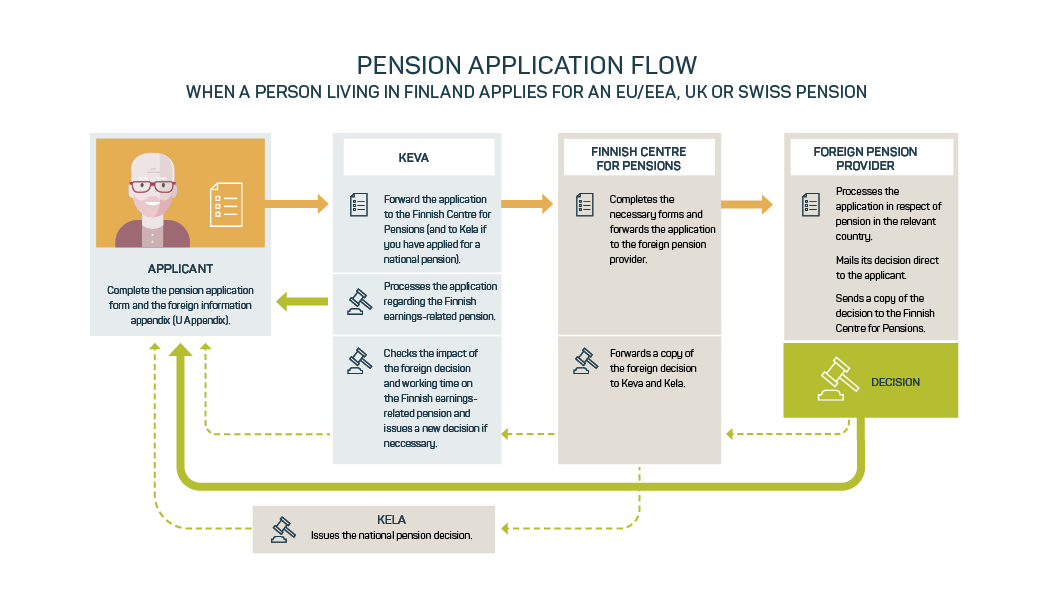

Figure. To open the image in a new window, click here.

How to apply for an old-age pension from abroad

You can apply for a foreign old-age pension when you apply for your Finnish pension if

- you are applying for both to start at the same time, or

- the foreign pension starts in no more than about a year from the starting time applied for.

In this case, please complete the "Application for an old-age pension".

You may apply for your foreign pension at a different time to your Finnish old-age pension if

- you want the foreign pension to start earlier than your Finnish old-age pension or

- you want the foreign pension to start more than a year later than your Finnish old-age pension.

In this case, please complete the "Application for a foreign old-age pension" (in Finnish) in My Pension service. We recommend that you submit a separate application for a foreign pension about six months before you have applied for the pension to start.

Use the My Pension service to apply for the pension.

If you are unable to use the My Pension service, you can also apply for a pension on a paper application form. Send the completed application and U Appendix to: Keva, FI-00087 KEVA, Finland.

How to apply for a disability pension from abroad

You can use the same application form to apply for a disability pension from Finland and abroad. You can send your application to Keva.

Finnish medical reports are usually enough as such and the foreign provider can request more information if needed. Since disability is defined differently in different countries, the decision of the foreign pension provider may differ from Keva’s pension decision.

Read more about disability pension in Finland

How to apply for survivors’ pension from abroad

If the deceased had worked abroad, their spouse and children may be entitled to a foreign survivors’ pension. Age limits and other requirements may vary from one country to another.

You can apply for a surviving spouse’s pensions or child’s pension from abroad at the same time as you apply for a Finnish survivors’ pension.

If you have worked in another country

If you have worked in a country that is not an EU or EEA member state or in a country with which Finland does not have a social security agreement, you yourself must apply for your pension from abroad.

Ask the Finnish Centre for Pensions for advice on how to apply:

If you already receive a pension from a country that is not an EU or EEA member state or from a country with which Finland does not have a social security agreement, for example from Russia, please attach a copy of the relevant country’s pension decision to your application for a Finnish pension.

More information about pensions in different countries

There are considerable differences in the pensions systems in different countries. Likewise, pension application procedures and practices differ from one country to another.

- Earnings-related pension paid abroad from Finland (tyoelake.fi)

- Pension from abroad to Finland (tyoelake.fi)

How to apply for a Finnish pension when you live abroad

Have you earned a pension in Finland but are now resident abroad? You pension will be paid to you regardless of where you live.

If you live in an EU or EEA member state or in a country with which Finland has a social security agreement

You should apply for your pension in the country in which you live. Each EU and EEA member state has a coordinating agency that deals with pension affairs and applications for Finnish earnings-related pensions are made through this agency.

Coordinating agencies are usually the same agencies that process applications in respect of pensions accrued in their own country. If you do not know the coordinating agency in the country in which you live, you can ask

If you live in another country

Apply for your earnings-related pension directly from Finland. You can apply through the My Pension service if you have Finnish online banking credentials. You can also print out the Finnish application forms and mail them to Keva.

More detailed instructions can be found on the page

You can enquire about your retirement age and preliminary assessment in the My Pension service or by phoning Keva’s customer service.

If you have worked abroad in the service of the Finnish Government

If you have worked abroad in the service of the Finnish Government but are not a Finnish citizen, use the form below (in Finnish) to apply for a supplementary pension.

Send the form by regular mail to Keva, FI-00087 KEVA, Finland.

You can report information on work done abroad in advance

You can report information on work done abroad in the My Pension service even if you are not yet applying for a pension.

Report information on work you have done abroad in the “Asuminen ja työskentely ulkomailla” (Residence and working abroad) section of the My Pension service (available in Finnish and Swedish). If you use a laptop to access the service, you can find it under your own name. If you use a smart phone or tablet to access the service, you will find it in the menu.

Once you have reported this information in advance, you will no longer need to complete it when you apply for a pension.

Keva will not process the information on work you have done abroad until you apply for a pension. The information is not transferred, for example, to your earnings-related pension record. However, the information will be stored in Keva’s My Pension service. You can modify or print out the information at any time.

If you subsequently become a customer of another earnings-related pension provider than Keva, you should print out the information. The information is not automatically transferred from Keva to another pension provider.

Reporting information on work you have done abroad does not yet mean that you are applying for a foreign pension. When you wish to apply for a foreign pension, complete the pension application in the My Pension service and state that you are applying for a foreign pension. The information you have stored earlier will be transferred as an attachment to your application.

On what can I accrue pension abroad, i.e. what information should I report?

- Working abroad in the service of a foreign employer

- Studying abroad where this is not a student exchange from a Finnish educational institution

- Permanent residence in a country where there is residence-based pension provision (e.g. the Nordic countries, the Netherlands, Canada or Australia)

What do I not need to report?

- Working in the service of a Finnish employer: posted workers, diplomats, Finnish UN peacekeepers

- Working or studying on a grant received from Finland

- Voluntary work or unpaid internships

- Holiday trips or other temporary stays abroad