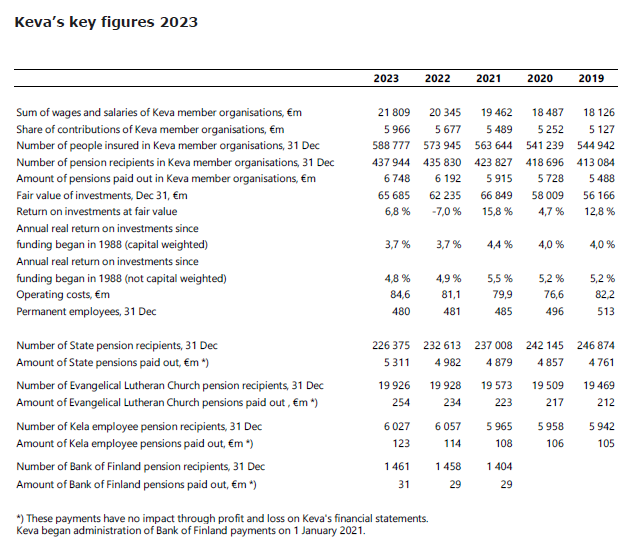

Keva, which is responsible for the funding of local government pensions and the investment of pension funds, reported a total return on Keva’s investments at market value of 6.8% or EUR 4.2 billion for 2023.

Of Keva’s investment assets, the best performers were listed equities, which generated a return of 10.1%, fixed income investments 9.0%, hedge funds 6.6% and private equity investments 2.8%, whereas real estate investments generated a return of -6.1%.

Keva’s investment assets had a market value totalling EUR 65.7 billion at year-end 2023. Of this, listed equities accounted for 33.7%, fixed income investments 27.4%, private equity investments (including unlisted equities) 19.0%, hedge fund investments 6.9% and real estate investments for 6.9% of risk-based allocation. Derivatives had an impact of 6.1% on risk-based allocation.

Keva CEO Jaakko Kiander is pleased with investment performance.

Even though global economic development was volatile in 2023, growth was nevertheless reasonable compared to expectations. Inflation slowed clearly during the year. As the worst concerns of a recession receded and expectations of monetary policy eased, equity and fixed income investments performed rather well,” he says.

CIO Ari Huotari says that good investment performance was largely driven by the rally seen in the second half of last year.

At the end of the year, the markets were optimistic that inflation would recede with less impact on the economy than expected and there was optimism about central bank interest rate cuts. Thus, there was quite a "Santa Claus rally" in listed investments. On the other hand, impairments were made across the board in real estate investments last year," Huotari says.

current year, according to Huotari, shows the direction especially in terms of economic development in Europe.

Long-term investment performance still at a good level

Keva’s long-term return on investments has been at a good level. The cumulative capital-weighted real return on investments since funding began in 1988 to year-end 2023 was 3.7%. The average real return, excluding capital weighting, over the same period was 4.8%. The Finnish pension sector normally calculates long-term returns excluding capital weighting. Keva’s five-year real return excluding capital weighting has been 2.8% (nominal return 6.3%) and the ten-year return 3.6% (nominal return 5.7%).

Sum of wages and salaries of Keva member organisations increased

The sum of wages and salaries of Keva member organisations – towns and cities, municipalities, joint municipal authorities, municipal limited liability companies and wellbeing services counties – was EUR 21,809 million, up 7.2% compared to 2022. A total of EUR 6.1 billion in contribution income accrued. Keva paid out EUR 6.75 billion in local government and wellbeing services county pensions. The gap between contribution income and pension expenditure was met out of investment income.

In 2023, Keva paid out pensions totalling EUR 5.7 billion to State, Evangelical Lutheran Church, Social Insurance Institution of Finland (Kela) and Bank of Finland personnel. The State, Church, Kela and Bank of Finland fund their own pensions and Keva’s investment assets are used solely to cover local government and wellbeing services county pensions.

Decrease in pension applications

Keva received a total of 11% fewer pension applications than in 2022. Old-age pension applications were down 16% compared to the record year of 2022 and returned to the 2021 level. The number of partial early old-age pensions was approximately 7,300. This was around a third fewer than in 2022 but around 3,000 more than in the previous years. Application numbers levelled off and there was no rush of applications as seen in late 2022. Even though the index increase in earnings-related pensions from the beginning of 2024 was fairly high, the difference with the wage coefficient was so small that it was not worth rushing to apply for a pension.

Just over 62% of all pension applications in 2023 were made electronically through the Keva My Pension service. In addition to this, around 8% of pension applications arrived electronically via Keva, for example.

“All in all, Keva’s services worked well and customer satisfaction showed further improvement,” Jaakko Kiander notes.

Processing times of old age, disability and survivors’ pensions was further shortened and applications were processed an average of 3-7 days faster than in private institutions. Keva processed old-age pension applications on average in 4 days and disability pensions in 27 days. Partial early old-age pensions were processed fastest and decisions were issued in 2 days on average. Survivors’ pensions were processed in 6 days and rehabilitation decisions were issued in 16 days on average.

For further information, please contact:

Jaakko Kiander, CEO, tel. +358 20 614 2201

Ari Huotari, CIO, tel. +358 20 614 2205

Piia Laaksonen, CFO and Chief Actuary, tel. +358 20 614 2371

The figures in this release are preliminary and have not been subject to audit.

Keva’s financial statements, annual reports and interim reports are published on https://www.keva.fi/en/this-is-keva/financial-information/.

The report of the Board of Directors and financial statements will be published on our website after the meeting of Keva Councillors on 7 March.